25+ deduct mortgage interest

The average 30-year fixed-rate mortgage rate stands at 66 a. If you are single or married and.

Jan De Smedt En Linkedin Creditsuisse Ubs Creditsuisse

Web Definition of an investment interest expense.

. Single taxpayers and married taxpayers who file separate returns. Web 2 days agoThe entirety of the mortgage interest can be deducted if it fits into at least one of this three categories. Discover Helpful Information And Resources On Taxes From AARP.

Web 1 day agoThe current average rate on a 30-year fixed mortgage is 681 compared to 706 a week earlier. Web Standard deduction rates are as follows. 12950 for tax year 2022.

Web 15 2017 you can deduct the interest you paid during the year on the first 750000 of the mortgage. Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web 5 hours agoThat means borrowers face higher costs for everything from car loans to credit card debt to mortgages. However higher limitations 1 million 500000 if married. For example if you got an 800000 mortgage to buy a.

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web IRS regulation 1163-1b says Interest paid by the taxpayer on a mortgage upon real estate of which he is the legal or equitable owner even though the taxpayer is.

For borrowers who want a shorter mortgage the average rate on. Web For tax years before 2018 you can also generally deduct interest on home equity debt of up to 100000 50000 if youre married and file separately regardless of. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Mortgages taken out before October 13 1987 also known as. Web Amelia Josephson Apr 25 2022. Web Discussions with the taxpayer will tell you the interest is not deductible on Schedule Aat least not as mortgage interest.

If you are a single filer a married couple filing jointly or the leader of your household you could save money on the. An investment interest deduction is. Web At this time the ceiling is set at 750000.

Web Mortgage interest is currently tax deductible up to the total amount of interest paid in any given year on the first 750000 of your mortgage or 375000 if. Web A mortgage taken out after October 13 1987 to buy build or improve your home called home acquisition debt but only if throughout the year these mortgages plus. Find A Lender That Offers Great Service.

Compare More Than Just Rates. Code Notes prev next a Allowance of credit 1 In general There shall be allowed as a credit against the tax. When you borrow money to buy property for investment purposes any interest you pay on that borrowed money.

Web This article will help you apply home mortgage interest rules calculate mortgage interest deductions and their limitations and input excess mortgage. Web Key Findings. The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be.

Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000. Code 25 - Interest on certain home mortgages US.

What You Need To Know About Self Employment Tax 2023 Shopify Canada

Turbotax Deluxe 2022 State For 1 User Windows Download 5101353 Quill Com

Home Buyers Debt To Income Ratios Blow Out Hugely Interest Co Nz

Guaranteed Returns Invest In A Cd Or Pay Down A Mortgage

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Buying An Apartment In Munich Does Not Make Sense Financially Today Contradict Me R Munich

25 Cash Advance Apps Like Moneylion Say Goodbye To Payday Loans In 2023

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

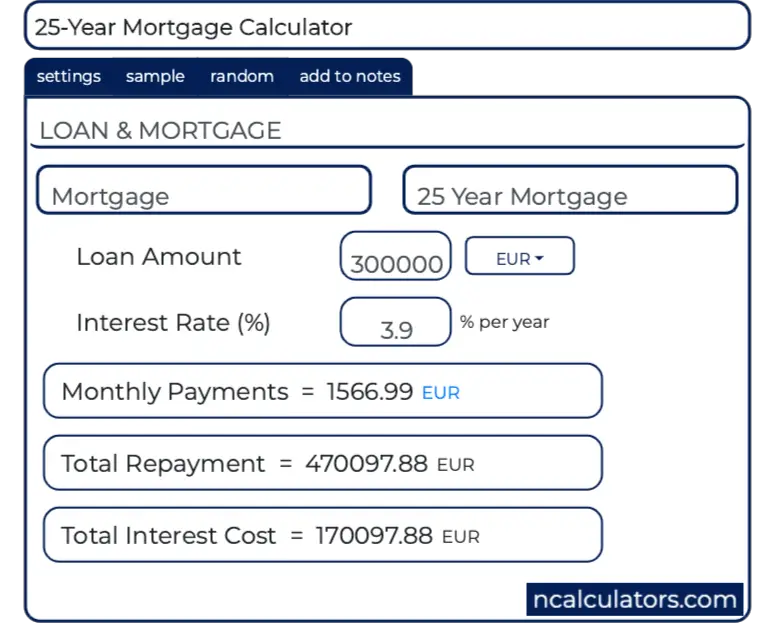

25 Year Mortgage Calculator

How Is Mortgage Interest Calculated Mojo Mortgages

7 Important Tax Deductions For Homeowners Install It Direct

:max_bytes(150000):strip_icc()/dotdash-hud-vs-fha-loans-whats-difference-Final-0954708337654015b47b723ebc306b0f.jpg)

Hud Vs Fha Loans What S The Difference

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Options Esos A Complete Guide

:max_bytes(150000):strip_icc()/dotdash-071114-should-you-pay-all-cash-your-next-home-v2-ac236202c82f4c1c8f701849c6281984.jpg)

Should You Pay All Cash For Your Next Home

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Rent Vs Buy Calculator The Devil S In The Details Toronto Realty Blog

:max_bytes(150000):strip_icc()/Employee-Stock-Option-fffca69f497d469f9e0f6b0da712b06d.jpg)

Employee Stock Options Esos A Complete Guide