50+ mortgage interest deduction vs standard deduction

Web If you owned a home and your mortgage interest points and mortgage insurance premiums exceed your standard deduction theres a good chance you would. However if your loan was in place by Dec.

Individual Taxation Flashcards Quizlet

Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan.

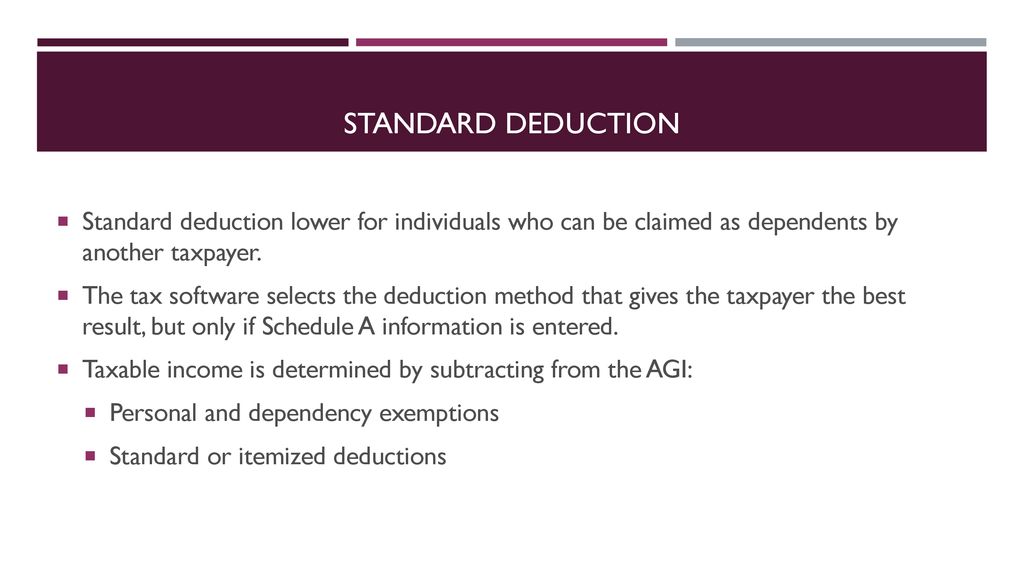

. Web Standard Deduction. The standard deduction lowers your. Web Mortgage interest deduction limit.

Web Mortgage Interest Deduction The tax law caps the mortgage interest you can write off at loan amounts of no more than 750000. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. If your home was purchased before Dec.

Web Yes most discussion of the mortgage interest deduction ignores the fact that for a standard itemizer much if not all of this deduction can be lost. 12950 for single taxpayers and married individuals filing separate returns. Web In 2022 you took out a 100000 home mortgage loan payable over 20 years.

The difference between the standard deduction and itemized deduction comes down to simple math. Homeowners who bought houses before. Web The standard deduction amount depends on the taxpayers filing status whether they are 65 or older or blind and whether another taxpayer can claim them as a.

You paid 4800 in. 16 2017 you can deduct the mortgage interest paid on your first 1 million in. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web Learn how to pass on more of your wealth to your heirs and pay less to the government before its too late. Web For 2022 tax returns those filed in 2023 the standard deduction numbers to beat are. Web Mortgage-Interest Deduction.

How It Works in 2022 - WSJ About WSJ News Corp is a global diversified media and information services company focused on creating. The terms of the loan are the same as for other 20-year loans offered in your area. For 2011 the std.

How Much It Is in 2022-2023 and When to Take It The 2022 standard deduction is 12950 for single filers 25900 for joint filers or 19400. Web Up to 96 cash back 4 min read.

The Standard Deduction And Personal Exemption Full Report Tax Policy Center

5 Often Overlooked Income Tax Breaks

At What Income Level Does The Marriage Penalty Tax Kick In

Standard Deduction And Tax Computation Ppt Download

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Or Standard Deduction Houselogic

Tax Deduction Definition Taxedu Tax Foundation

2023 Tax Brackets And Federal Income Tax Rates

J7c7w6fgdkkyvm

7 Physician Tax Deductions Doctors Miss Out On White Coat Investor

Standard Deduction 2019 In Income Tax

Calculating The Home Mortgage Interest Deduction Hmid

How The Tcja Tax Law Affects Your Personal Finances

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Form 11 Mortgage Interest Deduction Understand The Background Of Form 11 Mortgage Interest D Irs Tax Forms Mortgage Interest Irs Taxes

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports